In Partnership with: Financial Designs Inc.

Congratulations! After years of hard work, little sleep and lots of determination, you finished residency, and your paycheck finally reflects a physician’s salary. You are officially in the transition from resident to attending.

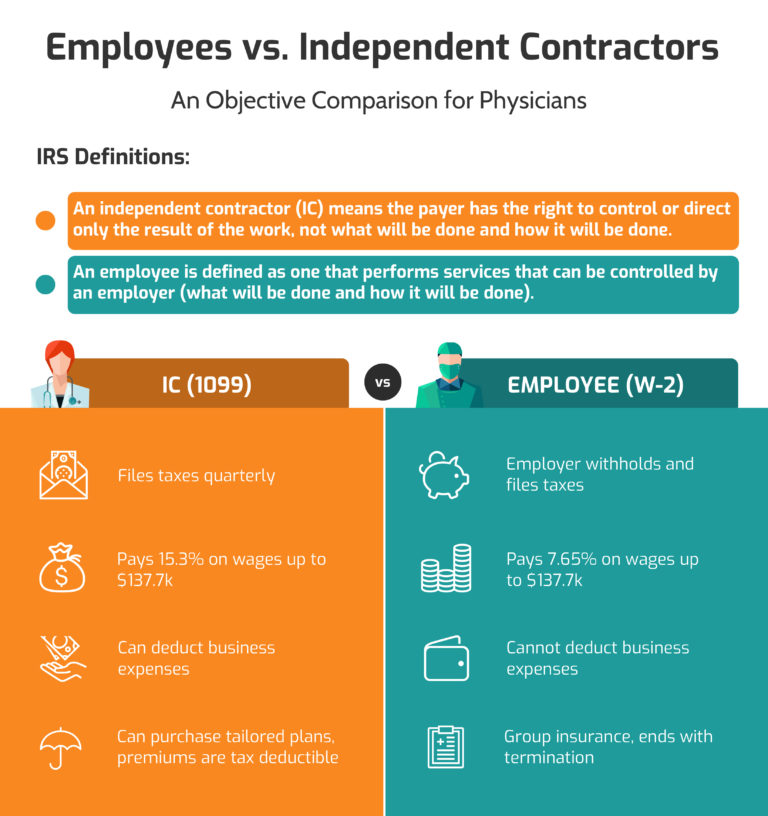

The increase from the average residency pay of $61,2001 to a full-time physician salary is typically large. The change can be overwhelming, and the details of starting as an independent contractor (IC) physician somewhat complex. Do not be discouraged. You will soon find the financial advantages and flexibility of IC status far outweigh the complexity. Use these tips to help you understand how to get started, and how to avoid potentially damaging financial mistakes.

1. Treat Yourself

Are you surprised we started with this piece of advice? You’ve worked hard to get to this phase in your life. You owe yourself a treat. However, before you go as far as a new sports car or an extravagant trip, read the below to ensure you are appropriately set-up for financial success.

2. Address Student Loans

“How should I address student loan debt?” This is one of the most common questions asked by new attendings.

Spoiler alert – you should try to eliminate debt as quickly as possible. You likely have some whopping loans to pay off. First, research Public Service Loan Forgiveness (PSLF). However, not every physician will qualify. If you don’t qualify for this type of loan forgiveness, be sure to research ways to consolidate and refinance your student loan debt. Scenarios will vary per loan type, amount and individual situation.

Start your research by acquiring quotes from several vendors to see what is offered and to ensure you receive a competitive offer. CommonBond, SoFi and Sallie Mae are a few examples of places to start. Just like a mortgage, consider refinancing on the shortest term possible because the savings on accrued interest can be staggering.

Lastly, when possible, make additional payments. When an unexpected bonus comes along, treat yourself, but also consider putting a significant portion of those earnings towards debt reduction.

3. Start Saving for Retirement NOW

Remember the financial advantages of being an IC mentioned earlier in this blog post? This is the first one. ICs can save up to $57,0002 a year in a tax-deductible retirement account. This may seem aggressive but putting it off can have a major impact on your path to financial independence.

Are you thinking about addressing debt before saving for retirement? We strongly recommend you work with a financial advisor (who is a fiduciary) to determine the impact on your long-term wealth. It’s worth researching before making a final decision. Your research will likely determine maintaining a balance of debt pay-off and tax-deductible retirement contributions is more financially efficient.

4. Maximize Your Tax Savings as an Independent Contractor

5. Eliminate Financial Risk

Healthcare costs are at an all-time high and the unexpected can wreak havoc on your finances. To financially mitigate medical surprises, you should secure adequate insurance coverage.

- Health Insurance: Evaluate high vs. low deductibles and the use of HSA plans. As an IC, work with a broker to help choose a plan to eliminate unnecessary costs and one which is tailored to your individual

- Disability Insurance: Your income is your most valuable asset. Just over 1 in 4 of today’s 20- year-olds will become disabled before they retire3. Keep in mind accidents are not usually the culprit. According to the Council for Disability Awareness, back injuries, cancer, heart disease and other illness cause the majority of long-term absences. As you research coverage, be sure to look into an “own occupation” rider and ask insurance brokers about discounts or exclusive pricing for

- Life Insurance: Consider planning ahead to provide for loved ones in the event you aren’t there to provide for them. Finding the right policy, or policies, to meet your individual needs can be difficult. Work with a broker to compare the advantages of term vs. permanent policies to keep premiums as low as possible while maximizing any future

Hopefully, these tips provide a helpful guide to get started as an IC physician during your transition from resident to attending. If you can check-off the above items, you will better position yourself to excel financially. Review financial plans every 6-months because life happens and sometimes tweaks are needed. If you do not currently have a CPA, financial advisor and/or insurance broker who specializes in IC physicians, reach out to our trusted partners at FinancialDesignsInc.com.

[2] Individuals over the age of 50 can contribute up to $63,500 annually

ApolloMD Disclaimer: The information provided is not written or intended as tax or legal advice and may not be relied on for purposes of avoiding federal tax penalties. Described in this text are some of the many advantages of being paid as an independent contractor (IC). The scenarios provided regarding tax saving and retirement planning strategies are neither recommendations nor suggestions but are merely examples. Individuals are encouraged to seek advice from their own financial advisor, CPA and/or legal counsel.

Financial Designs, Inc. Disclaimer: Securities offered through Cambridge Investment Research, Inc., a Broker/Dealer, Member FINRA/SIPC. Advisory services offered through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Cambridge does not offer tax advice. Financial Designs, Inc., Financial Designs Tax Services, LLC and Financial Designs Legal Services, LLC are not subsidiaries or affiliates of Cambridge Investment Research Advisors, Inc.